OANDA Minimum Deposit South Africa

Initial Deposit Requirements

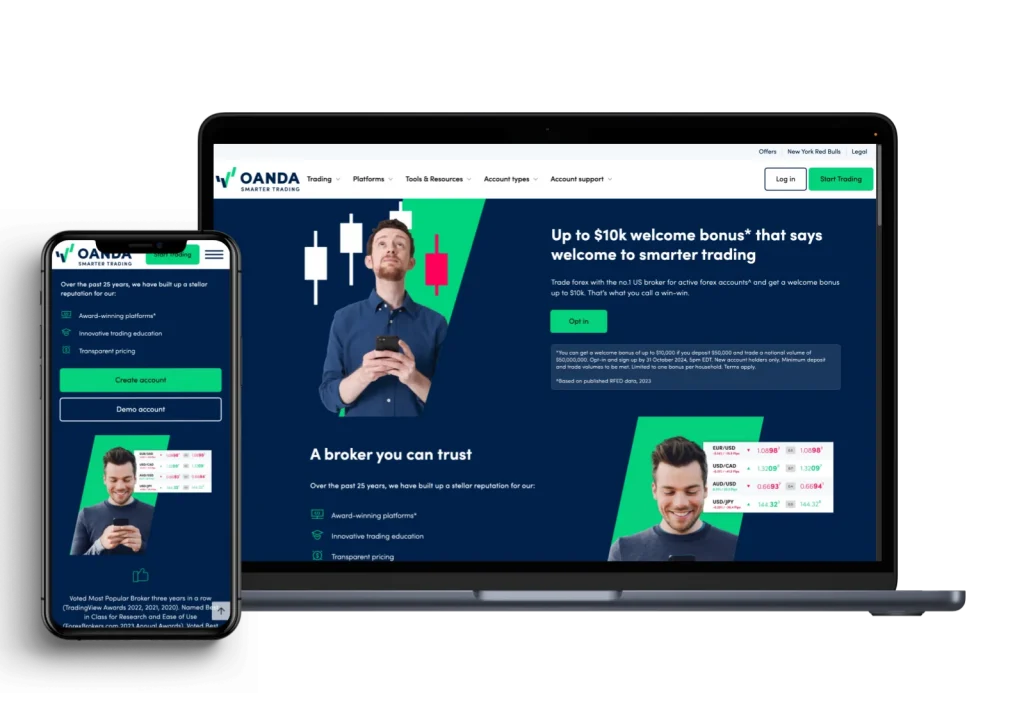

OANDA provides trading services in South Africa with accessible minimum deposit requirements in ZAR currency. The platform maintains transparent deposit conditions for all account types serving South African traders. The minimum deposit structure ensures accessibility while maintaining service quality standards for all clients.

Account Types and Deposit Levels

Different account categories require specific minimum deposit amounts based on service features. Each account type provides access to proportional trading capabilities and support services.

Account structures are designed to accommodate various trading volumes and styles. The minimum deposit requirements reflect service level differences and trading capabilities.

Standard Account Requirements

- Minimum deposit: R350

- Standard spreads

- Basic support services

- Standard execution

- Regular market analysis

Professional Account Features

- Higher minimum deposit requirements

- Enhanced trading conditions

- Priority support access

- Advanced tools access

- Professional execution services

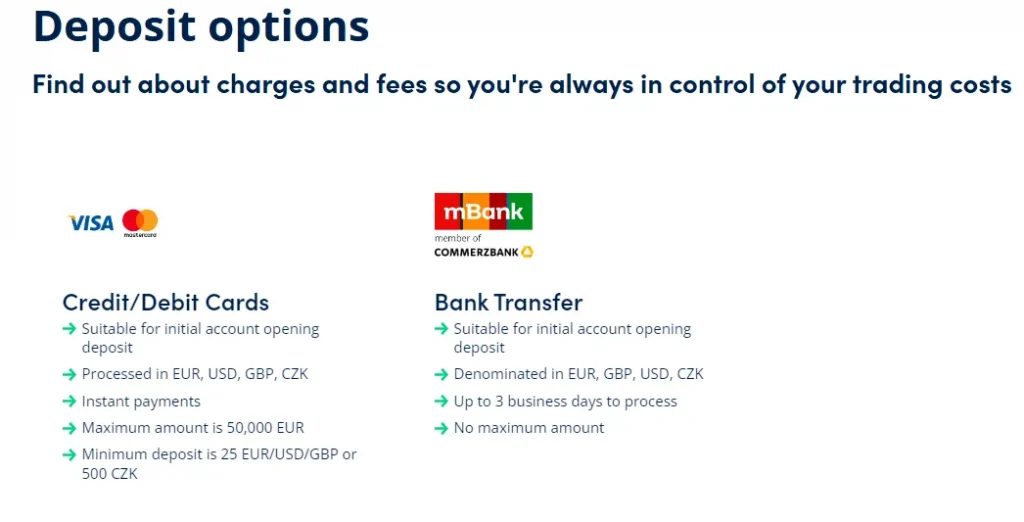

Deposit Methods Available

South African traders can utilize multiple payment methods for account funding. Each method maintains specific processing times and security protocols.

Payment processing follows local banking regulations and security standards. The system supports both electronic and traditional banking methods.

Table 1: Deposit Methods Overview

Method | Processing Time | Minimum Amount |

Bank Transfer | 1-3 days | R350 |

Credit Card | Instant | R350 |

Electronic Payment | Instant | R350 |

Processing Times and Procedures

Account funding follows systematic processing procedures ensuring security and efficiency. Each payment method undergoes verification according to regulatory requirements.

The processing system maintains continuous monitoring for transaction security. Deposit confirmations are provided through automated notifications.

Processing Requirements

- Account verification

- Payment source verification

- Documentation requirements

- Processing time frames

- Confirmation procedures

Currency Conversion Rates

Currency conversion applies to deposits made in currencies other than ZAR. Conversion rates follow market conditions with transparent fee structures.

The platform provides real-time conversion rate information during deposit processes. All conversion calculations are displayed before transaction confirmation.

Conversion Information

- Real-time rates

- Fee structures

- Processing times

- Currency pairs

- Market conditions

Security Measures

Deposit security implements multiple verification layers protecting client funds. Security protocols follow international standards and local regulations.

All transactions undergo systematic security checks ensuring fund safety. The platform maintains encrypted communication for all financial transactions.

Account Verification Requirements

Account verification follows regulatory compliance standards for South African traders. Documentation requirements ensure secure account access and fund protection.

Verification procedures maintain systematic processing with clear guidelines. Required documentation follows financial security regulations.

Required Documentation

- Identity verification

- Address proof

- Bank statements

- Source of funds

- Additional documents as required

Deposit Limitations

Transaction limits apply according to account type and verification level. The platform maintains structured limitation tiers protecting client interests.

Limitation adjustments follow account history and trading volume. Deposit limits ensure compliance with regulatory requirements.

Limitation Factors

- Account type restrictions

- Verification level limits

- Transaction frequency

- Amount thresholds

- Regulatory requirements

Additional Fees Information

Fee structures maintain transparency for all deposit methods. Each payment channel includes specific fee calculations where applicable.

Fee information is provided before transaction confirmation. The platform maintains updated fee schedules for all services.

Table 2: Fee Structure

Service Type | Fee Amount | Application |

Bank Transfer | No Fee | All amounts |

Card Payment | 0-2% | Transaction dependent |

Electronic Payment | Variable | Provider dependent |

Deposit Methods Available

Each payment method undergoes regular security assessment and optimization. The platform maintains relationships with major South African financial institutions ensuring reliable service.

Payment Method Benefits

- Bank Transfer: Enhanced security

- Credit Card: Instant processing

- Electronic Payment: Cost-effective

- Mobile Payment: Convenience

- Local Bank Integration: Reliability

Processing Times and Procedures

The system implements automated verification for recurring deposits from verified sources. Transaction monitoring ensures compliance with regulatory requirements and security standards.

Processing Stages

- Initial verification

- Source confirmation

- Amount validation

- Security checking

- Final processing

FAQ Based on Client Reviews

Bank transfers typically process within 1-3 business days, while electronic payments and card deposits process instantly after verification.

Yes, the platform accepts multiple currencies with conversion to ZAR at current market rates.

Deposits below R350 may be rejected or returned to the source account. The system provides notification if deposit amounts do not meet requirements.